The following TaxFoundation.org article with the title above was posted by Alan Cole and Scott Drenkard on July 8, 2015:

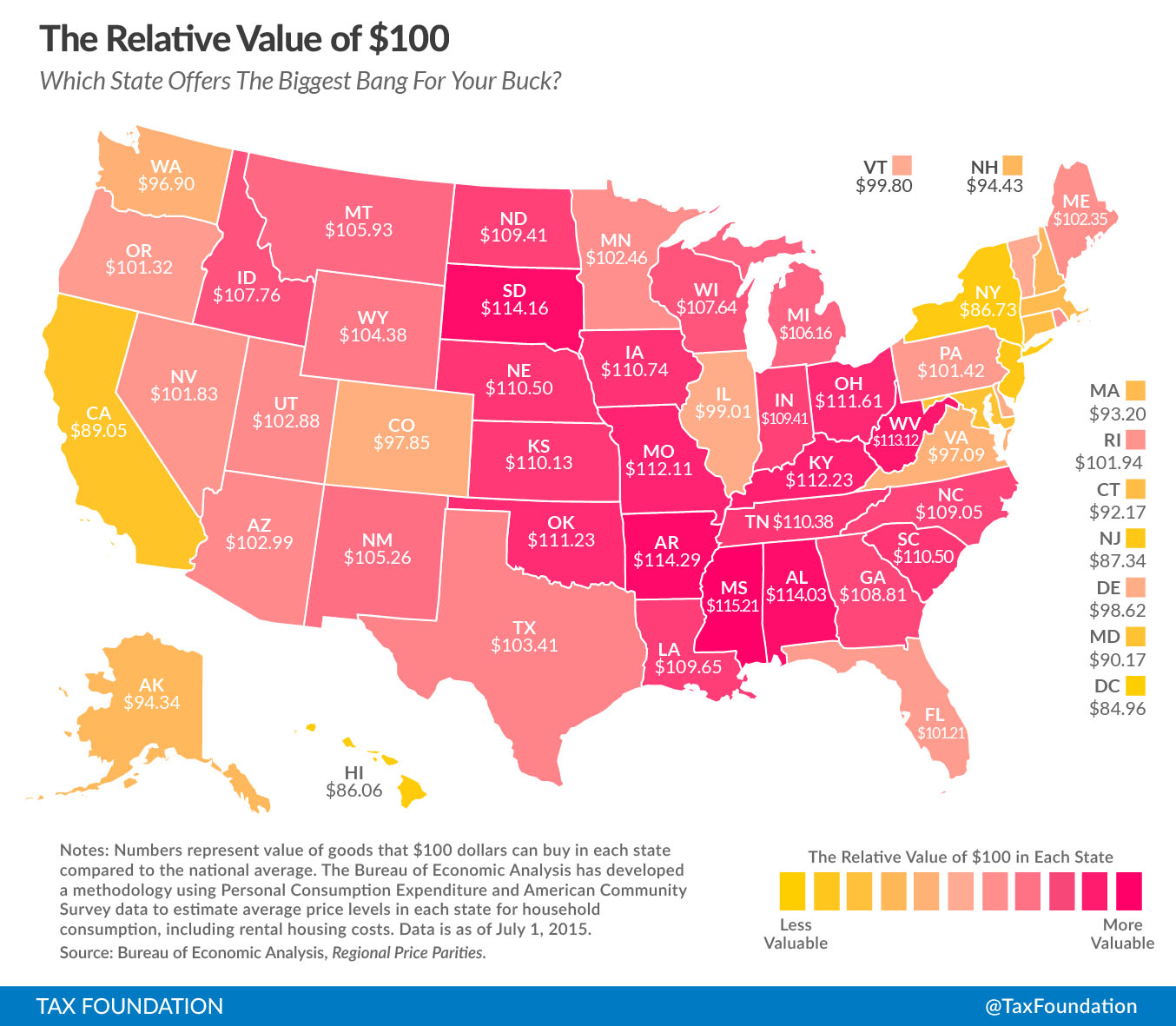

This week’s map shows the real value of $100 in each state. Prices for the same goods are often much cheaper in states like Missouri or Ohio than they are in states like New York or California. As a result, the same amount of cash can buy you comparatively more in a low-price state than in a high-price state.

The Bureau of Economic Analysis has been measuring this phenomenon for two years now; it recently published its data for prices in 2013. Using this data, we have adjusted the value of $100 to show how much it buys you in each state.

For example, Ohio is a low-price state. $100 there will buy you stuff that would cost $111.61 in a state closer to the national average. You could think of this as meaning that Ohioans are, for the purposes of day-to-day living, eleven percent richer than their incomes suggest.

The states where $100 is worth the most are Mississippi ($115.21), Arkansas ($114.29), South Dakota ($114.16), Alabama ($114.03), and West Virginia ($113.12). In contrast, $100 is effectively worth the least in the District of Columbia ($84.96), Hawaii ($86.06), New York ($86.73), New Jersey ($87.34), and California ($89.05).

Regional price differences are strikingly large; real purchasing power is 36 percent greater in Mississippi than it is in the District of Columbia. In other words: by this measure, if you have $50,000 in after tax income in Mississippi, you would have to have after-tax earnings of $68,000 in the District of Columbia just to afford the same overall standard of living.

It’s generally the case that states with higher nominal incomes also have higher price levels. This is because there is a relationship between the two: in places with higher incomes, the prices of finite resources like land get bid up. But the causation also runs in the opposite direction. Places with high costs of living pay higher salaries for the same jobs. This is what labor economists call a compensating differential; the higher pay is offered in order to make up for the low purchasing power.

This relationship is important, though it is not the only thing that matters. Some states, like North Dakota, have high incomes without high prices. Adjusting incomes for price level can substantially change our perceptions of which states are truly poor or rich.

For example, Nebraskans and Californians earn approximately the same amount in dollars per capita, but after adjusting for regional price parity, Nebraskan incomes can buy more. This has substantial implications for public policy, which is often progressive with respect to income.

Many policies – like minimum wage, public benefits, and tax brackets – are denominated in dollars. But with different price levels in each state, the amounts aren’t equivalent in purchasing power. This has some unexpected consequences; people in high-price-level states like New Jersey will often pay more in federal taxes without feeling particularly rich.